We often talk about the financial reasons why buying a home makes sense. But, more often than not, the emotional reasons are the more powerful and compelling ones.

No matter what shape or size your living space is, the concept and feeling of home can mean different things to different people. Whether it’s a certain scent or a favorite chair, that feeling of safety and security you gain from owning your own home is simultaneously one of the greatest and most difficult to describe.

Frederick Peters, a contributor for Forbes, recently wrote about that feeling, and the pride that comes from owning your own home.

“As homeowners discover, living in an owned home feels different from living in a rented home. It’s not just that an owner can personalize the space; it touches a chord even more fundamental than that.

Homeownership enhances the longing for self-determination at the heart of the American Dream. First-time homeowners, young or old, radiate not only pride but also a sense of arrival, a sense of being where they belong. It cannot be duplicated by owning a 99-year lease.”

Bottom Line

Owning a home brings a sense of accomplishment and confidence that cannot be achieved through renting. If you are debating renewing your lease, let’s get together before you do to answer any questions you may have about what your next steps should be, and what is required in today’s market!

Starting the search for your new home? Let the professionals with The McLeod Group Network help you find your dream home! 971.208.5093 or admin@mgnrealtors.com

By: KCM Crew

Amy's thoughts on Real Estate trends, community events & and her favorite charities.

Showing posts with label owning a home. Show all posts

Showing posts with label owning a home. Show all posts

Wednesday, June 5, 2019

Wednesday, August 1, 2018

6 Changes to Make After a Move to Start Off on the Right Foot

You're moving! And along with a new address, you get to enjoy a fresh start at life. OK, maybe you can't easily erase everything from your past—nor would you want to—but it is a good opportunity to break old habits that weren't helping, or were costing you money without much payback, or were causing more headaches than they solved.

For instance: If you usually have a landline phone, consider cutting the cord and going cellular. Or since you're changing your mailing address, sign up for paperless delivery of your important bills. Here are six other ways to change up your home life and daily routine for the better.

1. This time, actually unpack all those boxes

When people move, they eventually get tired of unpacking after a few weeks (and who can blame them?). And once you've unpacked the essentials, it's easy to take a break from unpacking—never to go back.

"Whether it's four more boxes or 14 more, you don't want them sitting in that same spot until your next move," says Kelly Tenny, content and social media manager for Zippboxx.com, a moving and on-demand storage company. So after you've moved households, make a realistic goal of when you'd like to have everything unpacked—and stick to it!

Services with auto-renewals you simply forgot to cancel—like that streaming channel that you subscribed to for just one show, or a magazine that goes straight to the recycling bin—can add up to a lot being deducted from your bank account.

"When my wife and I moved, we went through our budget line by line," says Mark Aselstine, founder of Uncorked Ventures. "We found subscriptions and subscription boxes—admittedly mostly for the kids—were starting to pile up unused."

Aselstine canceled the subscriptions his family no longer used and kept track of their savings.

Already subscribed to streaming services? Make sure you use them all; if not, it's time to pare down, or go back to good ol' public TV! That's what photographer S.J. Brown did when she moved into a house that had an antenna.

"For the price of one month's cable, I had it reconnected and am now enjoying free television," Brown says.

"Having a record of when you fixed something at a glance is hugely helpful," says Messenger.

If you bought your current digs, those records will also help with capital gains. And from a budgeting perspective, you'll know when the last time major systems such as the furnace, air conditioning, or roof were maintained, so you can budget for future upkeep.

"It's challenging with pets, but I feel much more pride in my new home knowing I'm taking care of it," she says.

Another bonus? Messenger found doing a few small things daily meant her free time wasn't spent on massive cleanup days.

Are you searching for your new home? Let's the experts on The McLeod Group Network help you find it! 971.208.5093 or mcleodgroupoffice@gmail.com.

By: Margaret Heidenry, Realtor.com

For instance: If you usually have a landline phone, consider cutting the cord and going cellular. Or since you're changing your mailing address, sign up for paperless delivery of your important bills. Here are six other ways to change up your home life and daily routine for the better.

1. This time, actually unpack all those boxes

When people move, they eventually get tired of unpacking after a few weeks (and who can blame them?). And once you've unpacked the essentials, it's easy to take a break from unpacking—never to go back.

"Whether it's four more boxes or 14 more, you don't want them sitting in that same spot until your next move," says Kelly Tenny, content and social media manager for Zippboxx.com, a moving and on-demand storage company. So after you've moved households, make a realistic goal of when you'd like to have everything unpacked—and stick to it!

2. Purge unused subscriptions and other auto-renewal fees

"When you move, it's a good idea to look at all the deductions from your bank account," says agent Katie Messenger of Keller Williams Louisville East.Services with auto-renewals you simply forgot to cancel—like that streaming channel that you subscribed to for just one show, or a magazine that goes straight to the recycling bin—can add up to a lot being deducted from your bank account.

"When my wife and I moved, we went through our budget line by line," says Mark Aselstine, founder of Uncorked Ventures. "We found subscriptions and subscription boxes—admittedly mostly for the kids—were starting to pile up unused."

Aselstine canceled the subscriptions his family no longer used and kept track of their savings.

3. Cut the cord—or consolidate streaming services

"When my wife and I looked into cable TV plans in the area we were moving to, we were met with plans that totaled $130 per month," says Aselstine. He realized the pared-down local internet service provider cost only $35 a month; that, combined with Netflix for $10 and other cheap add-ons, could meet most of his TV needs for much less.Already subscribed to streaming services? Make sure you use them all; if not, it's time to pare down, or go back to good ol' public TV! That's what photographer S.J. Brown did when she moved into a house that had an antenna.

"For the price of one month's cable, I had it reconnected and am now enjoying free television," Brown says.

4. Switch to energy-efficient lightbulbs and dimmers

You'll be handling all of your lamps when you move, so why not make the swap to energy-saving LED lightbulbs? These lightbulbs can help the typical home save about $1,000 over 10 years. And while dimmers are best known for their ability to improve a room's ambiance, these devices also reduce energy consumption and cut costs on your power bill, leaving more money in your wallet.5. Resolve to keep records of all of your home improvements

Even though you just moved, you never know where life is going to take you. A surprise job offer may have you selling your new house sooner than expected."Having a record of when you fixed something at a glance is hugely helpful," says Messenger.

If you bought your current digs, those records will also help with capital gains. And from a budgeting perspective, you'll know when the last time major systems such as the furnace, air conditioning, or roof were maintained, so you can budget for future upkeep.

6. Start a new cleaning ritual

"If you've been in a house for years, chances are you learned to live with some deferred maintenance–type things," says Messenger. When she moved, Messenger made it her mission to always keep her house tidy in case someone stopped by for a surprise visit."It's challenging with pets, but I feel much more pride in my new home knowing I'm taking care of it," she says.

Another bonus? Messenger found doing a few small things daily meant her free time wasn't spent on massive cleanup days.

Are you searching for your new home? Let's the experts on The McLeod Group Network help you find it! 971.208.5093 or mcleodgroupoffice@gmail.com.

By: Margaret Heidenry, Realtor.com

Monday, May 14, 2018

Homeownership: “A Man Is Not a Complete Man, Unless He Owns a House”

The famous quote by Walt Whitman, “A man is not a whole and complete man, unless he owns a house and the ground it stands on,” can be used to describe homeownership in America today. The Census revealed that the percentage of homeowners in America has been steadily climbing back up since hitting a 50-year low in 2016. The homeownership rate in the first quarter of 2018 was 64.2%, higher than last year’s 63.6%.

Chief Economist, Dr. Ralph McLaughlin, in his VUE Blog gave these new homeownership numbers some context:

“The trend is clear: the homeownership rate has been ticking up for five consecutive quarters, and the number of new renter households has fallen for four consecutive quarters. Owner-occupied households grew by 1.345 million from a year ago, while the number of renters actually fell by 286,000 households.

The fact that we now have four consecutive quarters where owner households increased while renter households fell is a strong sign households are making a switch from renting to buying. This is a trend that multifamily builders, investors, and landlords should take note of.”

In a separate article comparing the rental population in America to the homeowner population, Realtor.com also concluded that the gap is now shrinking:

“The U.S. added 1.3 million owner households over the last year and lost 286,000 renter households, the fourth consecutive quarter in which the number of renter households declined from the same quarter a year earlier. That could pose challenges for apartment landlords, who are bracing this year for one of the largest infusions of new rental supply in three decades.”

America’s belief in homeownership was also evidenced in a survey conducted by Pew Research. They asked consumers “How important is homeownership to achieving the American Dream?”

The results:

- 43% said homeownership was essential to the American Dream

- 48% said homeownership was important to the American Dream

- Only 9% said it was not important

Bottom Line

Homeownership has been, is, and always will be a crucial part of the American Dream.

Contact The McLeod Group Network today to find your dream home! 971.208.5093 or mcleodgroupoffice@gmail.com.

By: KCM Crew

Wednesday, February 7, 2018

Whether You Rent or Buy, Either Way You’re Paying a Mortgage!

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize, however, that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

Christina Boyle, Senior Vice President and head of the Single-Family Sales & Relationship Management organization at Freddie Mac, explains another benefit of securing a mortgage as opposed to paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person building that equity.

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.22% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

Contact The McLeod Group Network today to discuss your options! 971.208.5093 or mcleodgroupoffice@gmail.com.

By: KCM Crew

Wednesday, January 3, 2018

The Benefits of Homeownership Go Beyond the Financial

Homeownership is a major part of the American Dream. As evidence of that, 91% of Americans believe that owning a home is either essential (43%) or important (48%) to achieving that “dream.” In a market where some people may be unsure about the benefits and possibilities of buying a home, it is important that we remember this.

Homeownership is NOT just about the money. In fact, some of the major benefits are non-financial. Here are a few of those benefits as per the National Association of Realtors:

Let The McLeod Group Network help you achieve your dream of homeownership. 971.208.5093 or mcleodgroupoffice@gmail.com.

By: KCM Crew

Homeownership is NOT just about the money. In fact, some of the major benefits are non-financial. Here are a few of those benefits as per the National Association of Realtors:

- Consistent findings show that homeownership does make a significant positive impact on educational achievement.

- Several researchers have found that homeowners tend to be more involved in their communities than renters.

- Early studies of homeownership and health outcomes found that homeowners and children of homeowners are generally happier and healthier than non-owners, even after controlling for factors such as income and education levels that are also associated with positive health outcomes and positively correlated with homeownership.

Bottom Line

Homeownership means something more to people and their families than just the financial considerations.Let The McLeod Group Network help you achieve your dream of homeownership. 971.208.5093 or mcleodgroupoffice@gmail.com.

By: KCM Crew

Monday, November 27, 2017

The Cost of NOT Owning Your Home

Owning a home has great financial benefits, yet many continue to rent! Today, let’s look at the financial reasons why owning a home of your own has been a part of the American Dream for as long as America has existed.

Zillow recently reported that:

“In reality, buying or renting a home is an intensely personal decision, with emotional and even financial considerations that go beyond whether to invest in this one (admittedly large) asset. Looking strictly at housing market numbers, there is a concrete point at which buying a home makes more financial sense than renting it.”

What proof exists that owning is financially better than renting?

1. We recently highlighted the top 5 financial benefits of homeownership:

- Homeownership is a form of forced savings.

- Homeownership provides tax savings.

- Homeownership allows you to lock in your monthly housing cost.

- Buying a home is cheaper than renting.

- No other investment lets you live inside of it.

2. Studies have shown that a homeowner’s net worth is 44x greater than that of a renter.

3. Just a few months ago, we explained that a family that purchased an average-priced home at the beginning of 2017 could build more than $48,000 in family wealth over the next five years.

4. Some argue that renting eliminates the cost of taxes and home repairs, but every potential renter must realize that all the expenses the landlord incurs are already baked into the rent payment– along with a profit margin!!

Bottom LineOwning a home has always been, and will always be, better from a financial standpoint than renting.

Meet with McLeod Group Network to discuss your options! 971.208.5093 or mcleodgroupoffice@gmail.com

By: KCM Crew

Thursday, October 5, 2017

The Truth About Homeowner Equity

A recent article from a reputable news source was titled: Here's why some homeowners still can't sell. In the opening bullets of the article, the author claimed, “Negative equity is one of the main reasons why there are so few homes for sale.” The article then goes on to soften that stance but we want to bring better clarity to the equity situation.

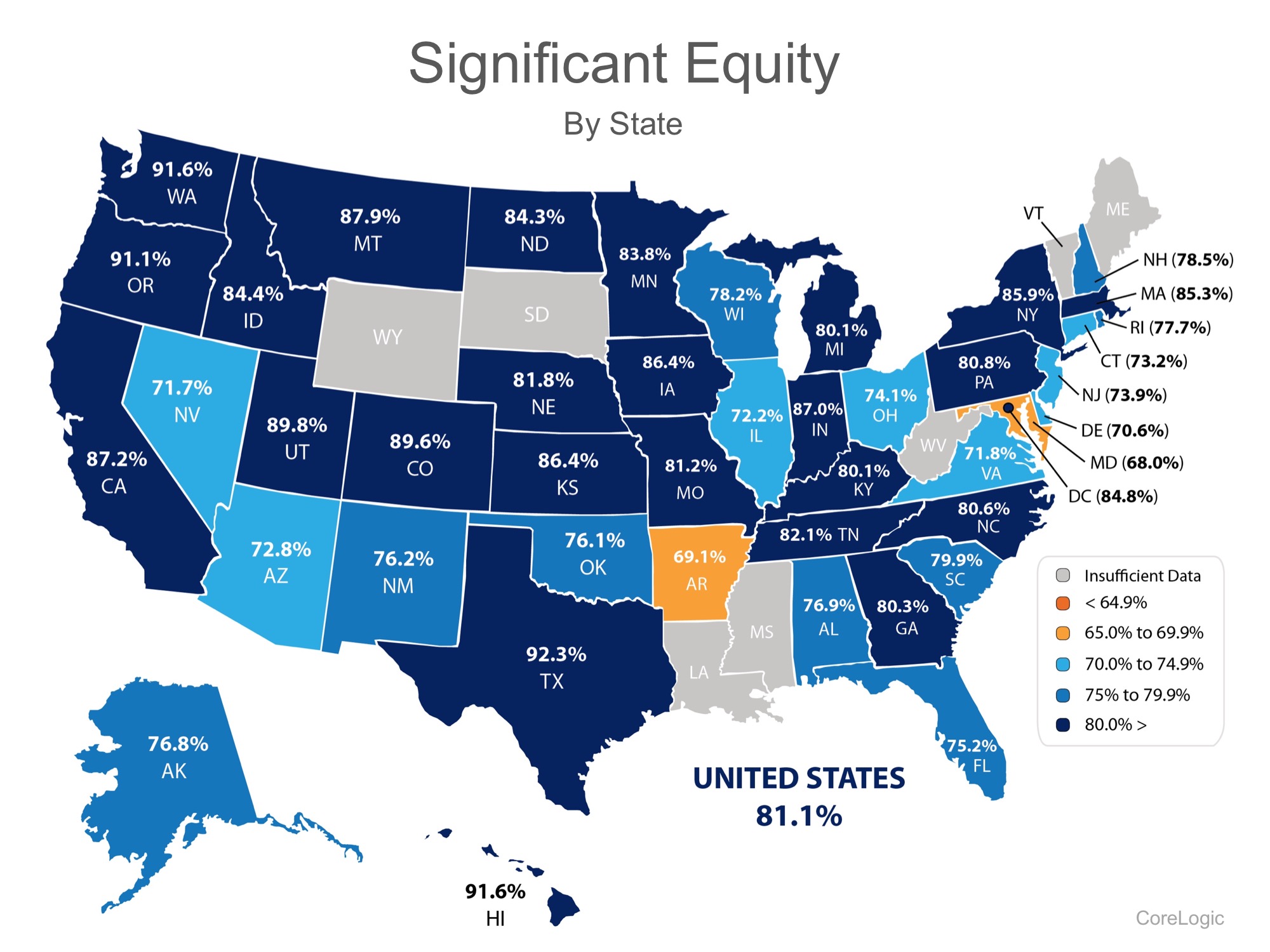

A recent report from CoreLogic (which was quoted in the article) revealed that over 80% of all homes now have “significant equity,” which means the home has over 20% equity. That level of equity allows the homeowner to sell their home if they so desire. (There was no reference to significant equity in the article.)

If eight out of ten homeowners now have significant equity in their homes, it is hard to make the claim that lack of equity is “one of the main reasons why there are so few homes for sale.”

Here is a map showing the percentage of homes in each state which currently have significant equity:

Bottom Line

If you are one of many homeowners who is debating selling your home and are wondering how much equity you have accumulated, let’s get together to determine if now is the time to list.

McLeod Group Network, 971.208.5093 or mcleodgroupoffice@gmail.com

By: KCM Crew

Tuesday, August 22, 2017

More Boomerang Buyers Are about to Enter the Market

We previously informed you about a study conducted by TransUnion titled, “The Bubble, the Burst and Now – What Happened to the Consumer?” The study revealed that 1.5 million homeowners who were negatively impacted by the housing crisis could re-enter the housing market between 2016-2019.

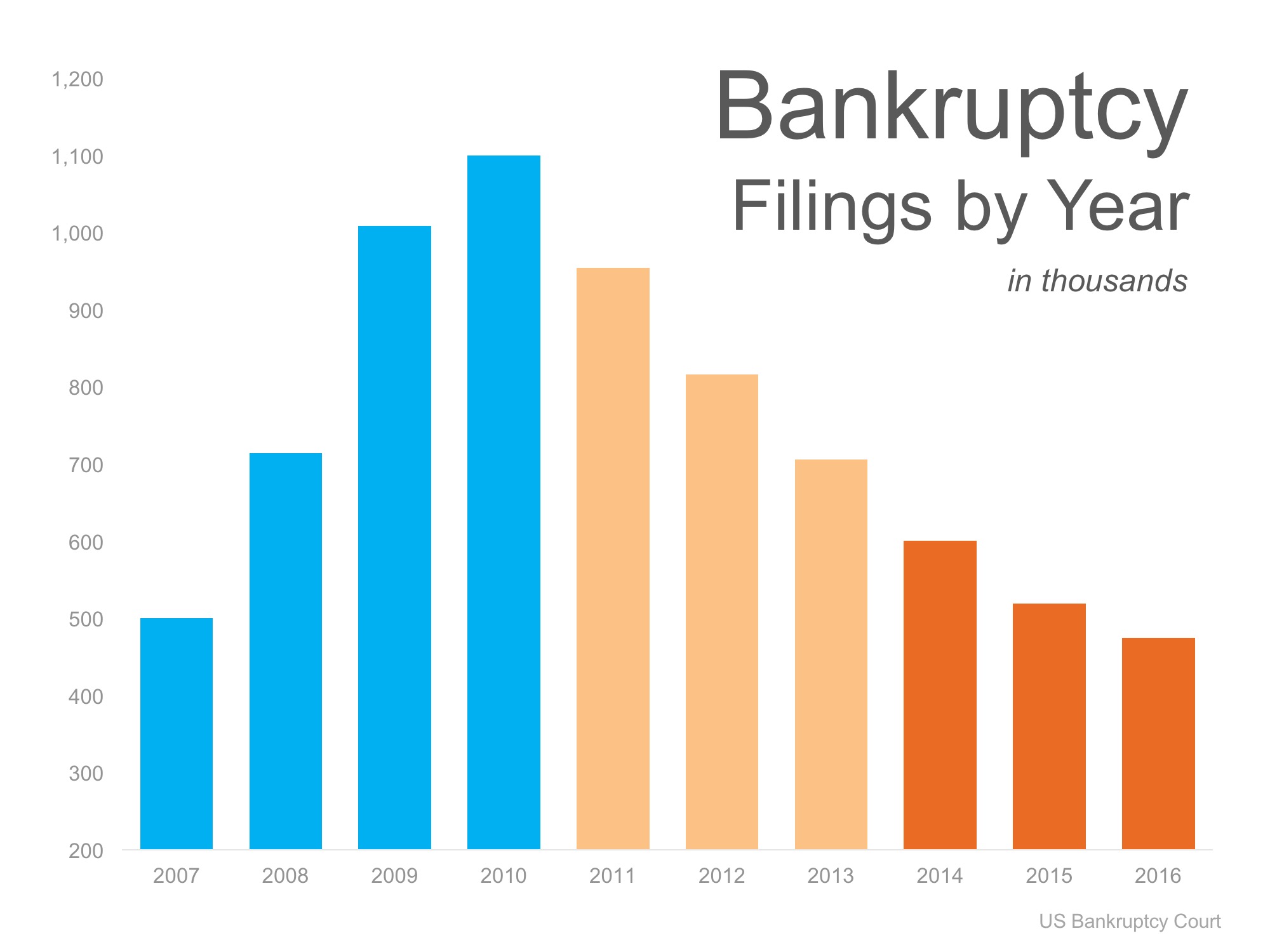

Recently, HousingWire analyzed data from the US Bankruptcy Courts and revealed that 6 million Americans will have their bankruptcies disappear off their credit reports over the next five years and that this could “possibly send a flood of more homebuyers into the housing market.”

The chart below shows the total number of bankruptcies filed by year in the US over the last 10 years. The light blue bars represent over 3.3 million people who have already waited the 7 years necessary for their reports to no longer include their bankruptcies.

How would this “send a flood of more homebuyers into the housing market”?

As the article mentioned, in 2010 the number of chapter 7 bankruptcies increased to nearly 1.14 million. Now, 7 years later, they will begin to fade from credit histories, enabling prospective buyers to become homeowners again once their credit scores improve.

As we can see from both reports, the homeownership rate has the opportunity to increase drastically over the next few years with all of these boomerang buyers returning to the market.

Bottom Line

If your family was negatively impacted by the housing bust, here is the light at the end of the tunnel! Contact McLeod Group Network to find out if you might be able to purchase your dream home faster than you think! 971.208.5093 or mcleodgroupoffice@gmail.com

By: KCM Crew

Thursday, July 20, 2017

84% of Americans Believe Buying a Home is a Good Financial Decision

According to the National Association of Realtors®’ 2017 National Housing Pulse Survey, 84% of Americans now believe that purchasing a home is a good financial decision. This is the highest percentage since 2007 – before the housing crisis. Those surveyed pointed out five major reasons why they believe homeownership is a good financial decision:

- Homeownership means the money you spend on housing goes towards building equity, rather than to a landlord

- Homeownership creates the opportunity to pay off a mortgage and own your home by the time you retire

- Homeownership is an investment opportunity that builds long-term wealth and increases net worth

- Homeownership means a stable and predictable monthly mortgage payment

- Homeownership allows for various deductions on federal, state, and local income taxes

The survey also revealed that the majority of Americans strongly agree that homeownership helps create safe, secure, and stable environments.

Bottom Line

Homeownership has always been and still is a crucial part of the American Dream.

Contact The McLeod Group Network to start searching for your new home! 971.208.5093 or mcleodgroupoffice@gmail.com.

BY: KCM Crew

Monday, May 15, 2017

Do You Know the Cost of NOT Owning Your Home?

Owning a home has great financial benefits, yet many continue renting! Today, let’s look at the financial reasons why owning a home of your own has been a part of the American Dream for as long as America has existed.

Zillow recently reported that:

“With Rents continuing to climb and interest rates staying low, many renters find themselves gazing over the homeownership fence and wondering if the grass really is greener. Leaving aside, for the moment, the difficulties of saving for a down payment, let’s focus on the monthly expenses of owning a home: it turns out that renters currently paying the median rent in many markets could afford to buy a higher-quality property than the typical (read: median-valued) home without increasing their monthly expenses.”

What proof exists that owning is financially better than renting?

1. The latest Rent Vs. Buy Report from Trulia pointed out the top 5 financial benefits of homeownership:

- Mortgage payments can be fixed while rents go up.

- Equity in your home can be a financial resource later.

- You can build wealth without paying capital gain.

- A mortgage can act as a forced savings account

- Overall, homeowners can enjoy greater wealth growth than renters.

2. Studies have shown that a homeowner’s net worth is 45x greater than that of a renter.

3. Just a few months ago, we explained that a family buying an average priced home at the beginning of 2017 could build more than $42,000 in family wealth over the next five years.

4. Some argue that renting eliminates the cost of taxes and home repairs, but every potential renter must realize that all the expenses the landlord incurs are already baked into the rent payment –along with a profit margin!!

Bottom Line

Owning a home has always been, and will always be, better from a financial standpoint than renting.

If you are ready to become a homeowner, contact The McLeod Group Network at 971.208.5093 or mcleodgroupoffice@gmail.com.

If you are ready to become a homeowner, contact The McLeod Group Network at 971.208.5093 or mcleodgroupoffice@gmail.com.

by The KCM Crew

Monday, May 8, 2017

Is 2017 the Year to Move Up to Your Dream Home? If So, Do It Early!

If you are considering moving up to your dream home, it may be better to do it earlier in the year than later. The two components of your monthly mortgage payment (home prices and interest rates) are both projected to increase as the year moves forward, and interest rates may increase rather dramatically. Here are some predictions on where rates will be by the end of the year:

Freddie Mac

“While full employment and rising inflation are signs of a strong economy, they also have the potential to push mortgage rates and house prices up. The higher rates and higher prices create significant affordability concerns, which may continue to characterize the housing market for the rest of 2017.”

Lynn Fisher, Vice President of Research & Economics for the Mortgage Bankers Association

“By the time we get to the fourth quarter of this year, we will still be under 5 percent – we are thinking 4.7 percent…Something north of 5 percent by the time we get to 2018, and by the time we get to 2019, we show fourth-quarter rates hitting 5.5 percent.”

Mark Fleming, First American’s Chief Economist

“Despite some regional disparities, title agents and real estate professionals do not expect increasing mortgage rates to have a significant impact on the housing market this spring. Continued good economic news, increasing Millennial demand and confidence that buyers will remain in the market even if rates exceed 5 percent bode well for 2017 real estate.”

Len Kiefer, Deputy Chief Economist for Freddie Mac

“We will probably see rates higher at the end of year, around 4.5%.”

Bottom Line

If you are feeling good about your family’s economic future and are considering making a move to your dream home, doing it sooner rather than later makes the most sense. Contact The McLeod Group Network today at 971.208.5093 or mcleodgroupoffice@gmail.com.

by The KCM Crew

Subscribe to:

Posts (Atom)