Hi Friends,

There may be some of you who are going back & forth about whether it's a good time to make your first or next home purchase.

There are so many factors that play in to making that decision for every family.

But I came across the article below during my regular reading, and thought it might prove helpful for those who are in that exact position. Wondering when or it to make that move.

Take a read & let me know if you have any questions!

"Here are four great reasons to consider buying a home today, instead of waiting.

1. Prices Will Continue to Rise

The Home Price Expectation Survey polls a distinguished

panel of over 100 economists, investment strategists, and housing

market analysts. Their most recent report projects appreciation in home

values over the next five years to be between 30.8% (most optimistic)

and 9.4% (most pessimistic).

The bottom in home prices has come and gone. Home values will continue

to appreciate for years. Waiting no longer makes sense.

2. Mortgage Interest Rates Are Projected to Increase

Although the Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage are currently around 4.2%, Freddie Mac is projecting

that rates will increase to 5.2% by this time next year.

An increase in rates will impact YOUR monthly mortgage payment. Your

housing expense will be more a year from now if a mortgage is necessary

to purchase your next home.

3. Either Way, You are Paying a Mortgage

As a research paper from the Joint Center for Housing Studies at Harvard University explains:

“Households must consume housing whether they own or rent. Not even

accounting for more favorable tax treatment of owning, homeowners pay

debt service to pay down their own principal while households that rent

pay down the principal of a landlord plus a rate of return. That’s yet

another reason owning often does—as Americans intuit—end up making more

financial sense than renting.”

4. It’s Time to Move On with Your Life

The ‘cost’ of a home is determined by two major components: the price of

the home and the current mortgage rate. It appears that both are on the

rise.

But, what if they weren’t? Would you wait?

Look at the actual reason you are buying and decide whether it is worth

waiting. Whether you want to have a great place for your children to

grow up, you want your family to be safer, or you just want to have

control over renovations, maybe it is time to buy.

If the right thing for you and your family is to purchase a home this

year, buying sooner rather than later could lead to substantial savings"

Source: KCM Blog

As always, please let me know if there's any way I can be of help!

~Amy

Hi Friends!

It is a great honor of mine to be able to introduce our newest team member of The McLeod Group here at RE/MAX Integrity.

Terri Hays, Buyer Broker for The McLeod Group

503-371-5209

Terri Hays, Buyer Broker for The McLeod Group

503-371-5209

terrihays@integrityagents.com

Terri comes to our team with energy & excitement to work with Buyers as they search for their ideal home!

We are looking forward to continued success for Terri & The McLeod Group as we work together for you, our clients!

~Amy

Hi Friends!

I

often hear from Sellers & Buyers alike that they're going to

"wait" for the market to get "better." But sometimes

that waiting can cost you much more than you may have been expecting!

Take a moment and look over this article I found in my reading. I'm

hopeful this information may help some of you who are trying to decide if now

is the right time to make a change!

"Whether you are a first time buyer or a move-up buyer, you should

look at the projections housing experts are making in two major areas:

home prices and mortgage rates.

PRICES

Over 100 economists, real estate experts and investment & market strategists were recently surveyed.

They were asked to project where home prices were headed. The average

value appreciation projected over the next twelve month period was

approximately 4%.

MORTGAGE INTEREST RATES

In their last Economic & Housing Market Outlook, Freddie Mac predicted that 30 year fixed mortgage rates would be 4.8% by this time next year. As of last week, the Freddie Mac rate was 4.14%.

What does this mean to you?

If you are a first time buyer currently looking at a home priced at $250,000, this is what it could cost you on a monthly basis if you wait to buy next year:

If you are a move-up buyer currently looking at a home priced at $500,000, this is what it could cost you on a monthly basis if you wait to buy next year:

Bottom Line

With both home prices and interest rates projected to increase, buying now instead of later might make sense."

As always, please let me know if you have any questions at all!

~Amy

*Article courtesy of KCMBlog.com

Hi Friends,

Many of our buyer clients often have significant reasons to start their home purchase process.

But there are times when you may not be sure if now is just quite the right time to make a move.

Here are four great reasons why now might be the best opportunity to move & buy your next home now!

4 Reasons to Buy Your Home Now!

As always, please let me know if you have any questions or how I can best help you make that next move!

~Amy

Hi Friends,

I often hear from clients & friends alike that they plan or want to wait to make their next move until their current home is "worth more." What typically ends up happening is that the amount that these clients & friends want to make on their home is usually the same or similar amount that their dream home price increases.

In my reading, I thankfully came across this article that offers some additional insight on why waiting to make "more" might not always end up with the desired result. Take a look & let me know your thoughts!

"A recent study

revealed that the number of existing home owners planning to buy a home

this year is about to increase dramatically. Some are moving up, some

are downsizing and others are making a lateral move. Another study shows

that over 75% of these buyers will, in fact, be in that first category:

a move-up buyer. We want to address this group of buyers in today’s

blog post.

There is no way for us to predict the future but we can look at what

happened over the last year. Let’s look at buyers that considered moving

up last year but decided to wait instead.

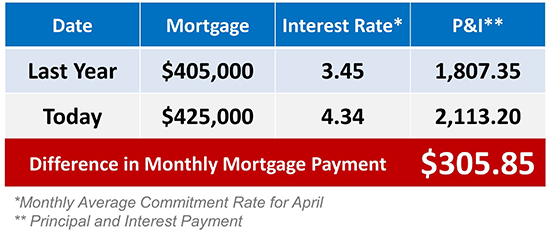

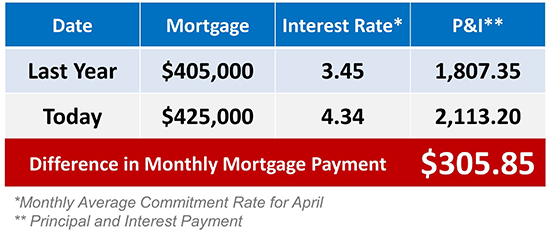

Assume they had a home worth $300,000 and were looking at a home for

$450,000 (putting 10% down they would get a mortgage of $405,000). By

waiting, their house appreciated by approximately 10% over the last year

(based on the Case Shiller Pricing Index). Their home

could now sell for $330,000. That would mean an additional $30,000 in

equity assuming they didn’t incur any expenses in selling the home.

But, the $450,000 home would now be worth $495,000. Adding the

original 10% down payment ($45,000) to the additional equity ($30,000),

they would now have a $75,000 down payment. That would still need a

mortgage of $425,000.

Here is a table showing what additional monthly cost would be incurred by waiting:

According to the Home Price Expectation Survey, home

prices are projected to appreciate by approximately 6% over the next

eighteen months. Interest rates are also expected to rise by as much as

another full percentage point in that same time period according to FreddieMac. If your family plans to move-up to a nicer or bigger home, it may make sense to move now rather than later."

As always, please let me know if you have any questions or want to take advantage of still great rates coupled with great pricing!

~Amy

According to the Home Price Expectation Survey, home

prices are projected to appreciate by approximately 6% over the next

eighteen months. Interest rates are also expected to rise by as much as

another full percentage point in that same time period according to FreddieMac. If your family plans to move-up to a nicer or bigger home, it may make sense to move now rather than later."

As always, please let me know if you have any questions or want to take advantage of still great rates coupled with great pricing!

~Amy

Hi Friends!

Ever wonder if it's worth using an agent to sell your home?

Well here's what FannieMae has to say about it!

In one of the biggest financial transactions of a person's life - it almost always makes sense to utilize the skills of a professional!

As always, I'm here if you have any questions!

~Amy

Hi Friends!

Wondering if you should "For Sale By Owner" your home?

Take a look at the graphic below for insight on how this option might not bring in your best rate of return!

As always, let me know if you have any questions!

~Amy